Unstructured Datasets:

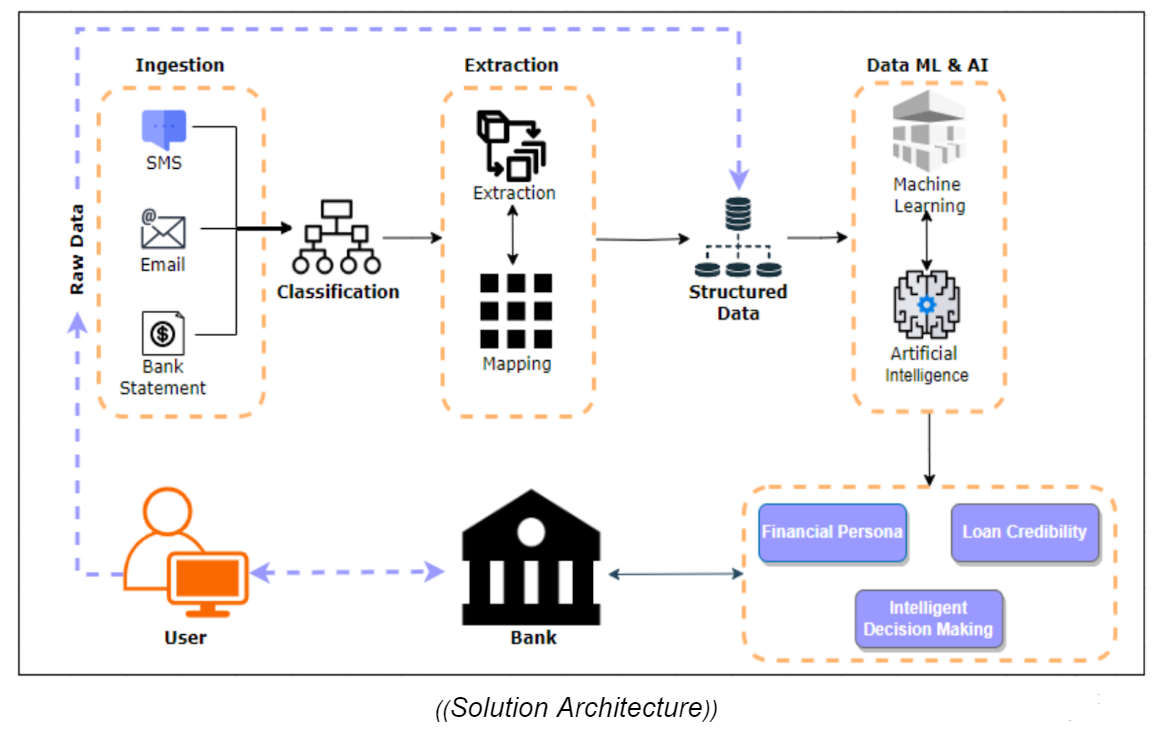

The firm faced challenges in extracting financial data from SMS and email messages due to the complexity of parsing text and recognizing entities.

Inaccurate Quality Analysis:

Ensuring the accuracy of extracted information manually was a struggle, highlighting the importance of data validation and quality analysis.

Missed Trends and Advancements:

Developing predictive models for analyzing financial data and predicting future trends proved to be a challenging task.

AI/ML Integration Complexities:

Implementing advanced machine learning algorithms and optimizing models added complexity, especially when integrating them with rule-based engines for improved accuracy.

Technical Glitches

Scalability and real-time processing posed technical concerns, particularly due to the substantial volume of financial messages.

Data Security and Compliance Concerns:

Managing data privacy and security was critical, especially when dealing with sensitive financial information in SMS and email communications, requiring compliance with data protection regulations.

Data Validation and Quality Analysis

Developed a data validation pipeline to check the accuracy and integrity of the extracted data, including cross-referencing data with existing financial records or databases.

Scoring Mechanism

Developed a proprietary custom scoring mechanism to evaluate the significance of each message, considering factors like sender trustworthiness, keywords, and transaction amounts. This algorithm, when combined with standard credit scores like CIBIL and Experian, provides a more robust scoring mechanism for further applications.

Data Segmentation

We categorized messages into different financial segments using NLP and keyword analysis, including banking transactions, investment updates, account statements, and more.

AI-Based Product Recommendations

Designed and developed custom recommendation engines for each financial segment to analyze the data and generate actionable insights, such as cross-selling, upselling, and credit needs.

Machine Learning Algorithms

We utilized machine learning algorithms for trend analysis, investment recommendations, and risk assessment in the financial data.

After establishing the comprehensive data strategy and solutions architecture in real-time, the finance company experienced the following outcomes:

Improved Credit Scoring: Our advanced credit scoring mechanism, which includes proprietary scoring algorithms combined with standard credit scores like CIBIL and Experian, significantly enhanced risk assessment accuracy. This allowed for more informed lending decisions, resulting in reduced risk exposure and improved profitability.

Reduced Loan Defaults: By implementing robust risk assessment measures, we were able to significantly reduce instances of loan defaults. This not only protected their financial interests but also strengthened their reputation as a reliable lender, attracting more customers and improving overall business performance.

Increased Revenue: Through our AI-driven recommendation engines, we were able to offer personalized upselling and cross-selling opportunities to their customers. By analyzing their financial data and behavior, we could suggest additional products or services that met their needs, leading to increased revenue per customer.

Enhanced Engagement: Our focus on personalized offers based on NLP and sentiment analysis improved customer engagement and loyalty. By tailoring our offers to match their preferences and needs, we were able to build stronger relationships with our customers, driving higher sales and retention rates.

All-in-all, by using a robust data-backed scoring system and AI-powered recommendation engines, our client has improved how they analyze financial data in text messages and emails. This has made them more efficient, kept clients happier, and helped them make better decisions, making them one of the top financial advisory firms in the States.

Financial Services & Banking

India

Joint Product Development Framework

Briefly describe the challenges you’re facing, and we’ll offer relevant insights, resources, or a quote.

Business Development Head

Discussing Tailored Business Solutions

DataToBiz is a Data Science, AI, and BI Consulting Firm that helps Startups, SMBs and Enterprises achieve their future vision of sustainable growth.

DataToBiz is a Data Science, AI, and BI Consulting Firm that helps Startups, SMBs and Enterprises achieve their future vision of sustainable growth.